YOU COULD PAY UP TO 28% LESS TAX ON YOUR VANGUARD INVESTMENTS WITH THE FOUNDATION SERIES US 500 FUND AND TOTAL WORLD FUND.

The new Foundation Series US 500 Fund and Total World Fund – both invested through index funds management pioneer Vanguard, can help Kiwis achieve their investment goals more effectively by using some of the most cost-and tax-efficient vehicles in the market.

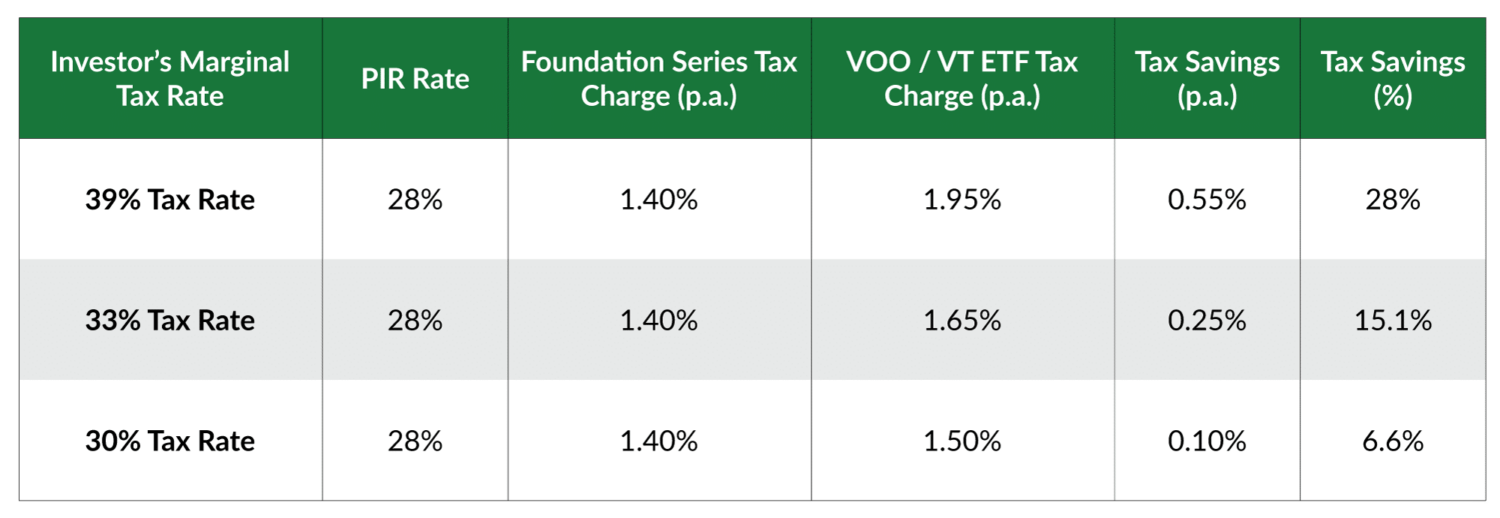

Multi-rate PIE (Portfolio Investment Entity) funds like the Foundation Series Funds have a maximum tax rate of 28%; by contrast, Kiwi investors who buy Vanguard Australian unit trust funds on InvestNow or in the same Vanguard ETFs (Vanguard 500 Index Fund (VOO) and (Vanguard Total World Stock Index Fund (VT)) via share brokers or other platforms will be taxed at their marginal tax rate, which can be as high as 39%.

Foreign Investment Funds (FIF) Fair Dividend Rate Calculation: 5% Taxable Income p.a. x 39% Marginal Tax Rate = 1.95% p.a. tax charge on assets

PIE Fair Dividend Rate Calculation: 5% Taxable Income p.a. x 28% Prescribed Investor Rate = 1.40% p.a. tax charge on assets

Tax savings (p.a.) = 1.95% – 1.40% = 0.55% p.a. of tax savings

Tax savings (%) = 0.55%/1.95% = 28%

“The low fees mean the new Foundation Series Funds beat out all other funds in the same class.

– InvestNow customer

FOUNDATION SERIES US 500 FUND AND TOTAL WORLD FUND HIGHLIGHTS:

- Expertise from the global investment powerhouse – Vanguard!

- Exposure to two of the most popular ETFs in the world in VOO and VT

- Incredibly low management fees of just 0.03% p.a. (US 500 Fund) and 0.07% p.a. (Total World Fund), matching the underlying Vanguard ETFs.

- Lower tax rates (capped at 28%), reflecting these are PIE funds.

- No tax returns required, as PIE tax is a final tax.

- One-off transaction fees of 0.50% on each buy and sell order.

THE FOUNDATION SERIES FUNDS WITH THEIR LOW MANAGEMENT FEES, ONE-OFF TRANSACTION FEES AND PIE TAX INCENTIVE ARE TAILOR-MADE FOR LONG-TERM INVESTORS, ESPECIALLY THOSE ON 30% OR HIGHER MARGINAL TAX RATES.

While choosing your investments and service provider, it is important to consider the overall cost of the investment, which includes management fees, tax efficiency, platform fees etc.

If you’d like to see the impact that these ‘overall costs’ can have on your investment portfolio, check out Money King NZ’s article “What’s the best S&P 500 index fund in 2022?” which includes a spreadsheet where you can do your own calculations and comparisons.

You can view and download the Product Disclosure Statement (PDS) for Foundation Series Funds here.

Please note:

InvestNow does not provide personalised investment advice. We are one component of a person’s financial landscape and actively promote that our customers seek personalised advice from qualified advisers external to InvestNow.

The Foundation Series US 500 Fund and Foundation Series Total World Fund are both subject to a transaction fee charge of 0.50% on all Buy Orders and 0.50% on all Sell Orders.

Neither FundRock NZ Limited nor any other party guarantees any returns.